Digitization in Wealth Management: Optimizing the Digital Experience

Harnessing Technology for Enhanced Client Engagement in Wealth Management

Driving Business Growth Through Digital Innovation in Wealth Management

For a long time, digital transformation in wealth management has been an important theme. Its adoption, however, has been relatively slow.

The wealth management industry is facing many challenges which include changing business models, fintech disruption, shifting client expectations, and revenue and fee compression pressures.

Understanding the Shift: The Role of Digitization in Wealth Management

Enhancing Client-Advisor Interactions Through Digital Solutions

Leveraging Technology for Smarter Financial Planning and Investment Management

Embracing Change: Adapting to the Digital Transformation in Wealth Management

Here are some important trends shaping the landscape:

Enable Financial Advisors

The financial advisory industry is transforming from a transaction-led model to a relationship-based one. Therefore, advisors need to provide personalized advice catered specifically to the client’s goals and life events. Digitization has been spearheading the advice-centric model evolution. Financial advisors require tools and insights to help with hyper-personalization, get a comprehensive view of clients, and efficiently service clients at scale.

Omni-Channel Servicing Capability

Advisors want their main attention to be on delivering client value and want to digitize tasks that are time-consuming and error prone. Digitizing account opening, account transitions, and e-signatures have helped reduce errors and NIGOs and improve operational scale.

Markets are volatile and uncertain, Therefore, the need for investment information and client servicing improved dramatically. A firm’s investments in giving advisors and clients an omnichannel experience will help them service their stakeholders effectively.

Data as a Strategic Asset

Leaders look at data as central to executing initiatives for providing high-touch services for operational transformation or using AI/ ML for client servicing and investment decisions. Making use of data, especially in the digital world, to offer insights and personalized services will remain a critical priority for wealth managers. Understanding and working with data growth, making sure of the data quality and integrity, harmonizing disparate data sources, and putting good data governance practices are imperative to generate actionable insights for decision-makers.

AI/ML Adoption to Rise Steadily

AI/ML in the wealth management industry is systematically moving from drawing boards to practical usage, but the use cases are still limited. The most notable use of AI/ML remains to be Robo advisory. Firms have deployed these tools to attract younger investors.

Firms have recently started using AI/ML in other areas. This includes improving lead conversion and unstructured data ingestion using OCR and character recognition.

In times to come, AI/ML will be utilized for recommending the next best action, chatbots, stock analytics and ranking (already underway), and generating alpha. Thereby, helping wealth managers in client servicing as well as investment decision making.

Move to the Cloud

Many firms in the wealth management industry have embarked earlier on their cloud adoption journey. This, primarily to help improve flexibility, scalability, and resilience and reduce infrastructure complexity. The pandemic has not affected organizations’ cloud strategy. Rather, given how firms scaled with increased trading, volatility, and application usage, it provided validation for resilience and scalability offered by the cloud.

Operations Transformation

Many firms struggle with inefficiencies that are introduced by legacy platforms, workarounds, and customizations built with an aim to support business. Business leaders have to decide between building focused-point automation and large-scale transformation. Operations transformation needs firms to redesign their legacy processes as well to eliminate activities that are inefficient and non-value-adding.

FinTech and New Players

FinTechs have assisted in scaling up the technology choices for advisors and pushing the digital agenda forward. The need to capture more customer wallet share as well as industry consolidation is resulting in overlapping services of many industry players.

In the coming times, expect tech giants such as Facebook, Apple, Amazon, and Google to foray into wealth management. The adoption of digital technologies and the harnessing of data will stand the incumbent firms in good stead against such competition, and new players will augment the industry move forward.

The Benefits of Digitalization for Financial Advisors and Wealth Management Firms

Improving Client Experience: Key Elements of a Successful Digital Strategy

Overcoming Challenges: Navigating the Digital Landscape in Wealth Management

Future Trends: Exploring the Evolving Role of Technology in Wealth Management

How USEReady Can Help

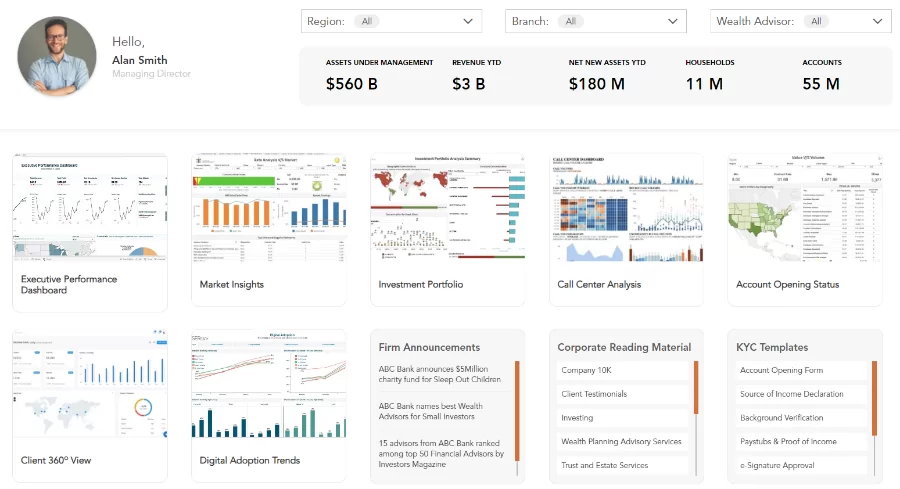

USEReady can help you lead through these changes and accelerate your digital transformation to gain a personalized and meaningful understanding of your clients, risks, and the actions to take to optimize your business.

At USEReady, we partner extensively with Tableau, Tableau CRM for AI, Salesforce and Snowflake to solve digital and technology challenges for the wealth management industry. We work with 3 of the top 5 wealth managers in the world and have a team of experts with many years of direct industry experience. Our primary objective in any customer engagement is to accelerate time to value and return on investment.

I was recently invited to speak at a webinar on “Transforming the Digital Experience for Financial Advisors & Clients”.

Some key takeaways from the session:

- Learn how you can integrate data sources from wealth and asset management platforms

- Find insights with Tableau that can be quickly shared internally and externally with clients

- Best practices from global wealth and asset management firms in successfully transforming clients and financial advisors’ digital experience using Tableau.